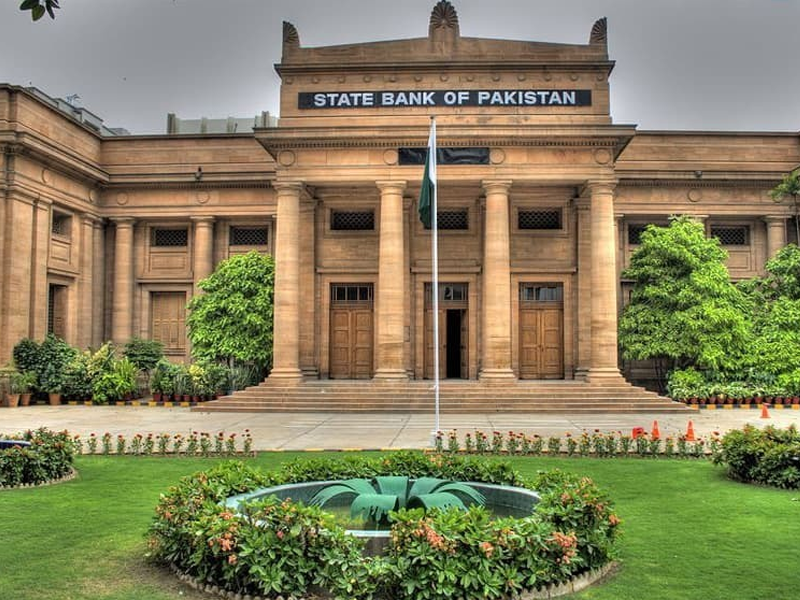

SBP keeps interest rate unchanged at 15pc

Monetary policy

- 321

- 0

KARACHI: In line with market expectations, State Bank of Pakistan (SBP) maintained status quo in interest rate at 15 percent highest since November 2008. Monetary policy committee (MPC) met under chair of Deputy Governor Syed Murtaza and reviewed economic indicators. Despite record high inflation central bank decided to keep interest rate unchanged for next six weeks. Central bank cumulatively increased rate by 800 basis points from September 2021 to July 2022 to control inflation and narrow current account deficit.

Central bank felt that it was “prudent to take a pause at this stage” as it noted that recent inflation developments are in line with expectations, domestic demand is beginning to moderate and external position is also showing some improvement due to a lower trade deficit and resumption of International Monetary Fund programme. Committee noted that in order to contain external pressures and support rupee going forward, “It is important to contain current account deficit by delivering budgeted fiscal consolidation, lowering energy imports through energy conservation measures, and keeping IMF programme on track.” Headline inflation rose further to 24.9 percent in July, with core inflation also ticking up. Trade balance fell sharply in July and rupee has reversed course during August, appreciating by around 10 percent on improved fundamentals and sentiment. In its forward guidance, central bank hinted at tightening policy rate in next meeting scheduled to be held on October 10.

Central bank projected that in coming months, curbing food inflation through supply-side measures that boost output and resolve supply-chain bottlenecks should be a high priority. “MPC will continue to carefully monitor developments affecting medium-term prospects for inflation, financial stability and growth,” it maintained. Terming decision taken by central bank as “good”, Alpha Beta Core CEO Khurram Schehzad lauded central bank for not raising interest rate anymore.

Published in The Daily National Courier, August, 23 2022

Like Business on Facebook, follow @DailyNCourier on Twitter to stay informed and join in the conversation.