Defence Minister’s statement adds to uncertainty on economic front

- 213

- 0

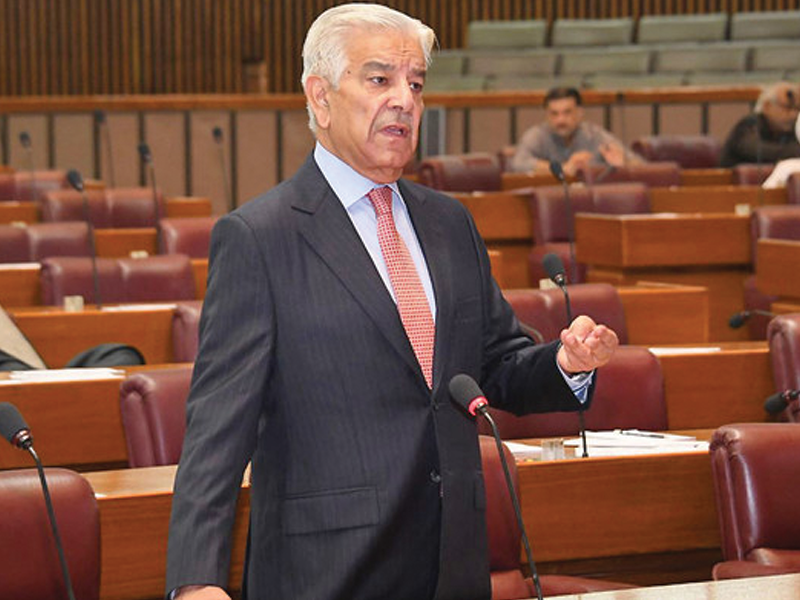

The Defence Minister Khawaja Asif statement on Saturday last, saying that Pakistan has already defaulted, is matter of grave concern as it has sent shockwaves among the investors, the business community and the public at large.

“You must have heard that Pakistan is going bankrupt or that a default or meltdown is taking place. It (default) has already taken place. We are living in a bankrupt country,” he announced during his address at a ceremony in Sialkot.

Meanwhile, the Stock market which was already in red zone, has shed another 42 points a It reached an intraday low of 494.64 points, or 1.2pc, around 3:27pm.

Any further delay in the passage of the Finance (Supplementary) Bill, 2023, can further deteriorate the economic situation. During the talks, the IMF had asked the government to raise an additional Rs170 billion in tax revenue.

Commonly known as the mini-budget, the above mentioned act comprises imposition of additional taxes and levies to meet the IMF’s conditions after which the country can get the IMF bailout.

On the other hand, the rumors regarding the interest rate hike by the SBP has also added fuel to the economic crisis.

The recent terrorist attack on Karachi Police Chief office in Karachi has also added to the uncertainty regarding security situation due to which the investors are pulling out their investments from Pakistan.

It may also be mentioned here that a massive Rs170 billion in taxes are in pipeline on part of the government due to which the masses are bracing for tough times ahead as for imposing these taxes, a mini budget will be introduced as the Finance Minister has already said in media talk.

The further drop in KSE-100 is also party attributed to the decline in the prices of shares of Oil and Gas Development Company Limited (OGDCL) as also the Pakistan Petroleum Limited (PPL).

After the gas and POL price hikes, the prospects of profit earning for the industries are low as it will add to cost of doing businesses.

As Pakistan is trying to secure the IMF bailout, the Govt has to swallow the bitter pill of meeting the monetary funds’ hard conditions, which have resulted in 34 per cent increase in gas prices for the industrial sector, which is already reeling in pain to the economic uncertainty and political instability in the country,

The prevailing economic situation has confused the investors and industrialists and a number of units have started their operations.

On the other hand, the shareholders of the stock market have started quitting the trading in haste in the wake of share market’s collapse and its unstable outlook with no imminent turned around in its fortunes unless the IMF deals is secured.

Economic experts and financial gurus predict tough times for the country and they have already termed the outgoing year as one of worst years for the stock market as the benchmark of share prices were down by a formidable 9.4 per cent from 2021, with the market remaining under pressure most of the time and now going nose-dive as investors are quitting the market in haste.

Rupee’s devaluation is also a factor as last year recorded a 22pc depreciation in the value of the Pak rupee against the US dollar due to which the dollar-based return of the KSE-100 index were recorded at 29pc which is really huge in nature.

And the prevailing scenario regarding our foreign exchange reserves which are at their lowest of less than US dollar three billion, which are barely enough for few weeks import cover, have created a panic-like situation.

The uncertainty has been shying away the investors who are scared of investing as the rupee’s fall is still continued which means the capital is being flowing out of the country unbridled.

Last month i.e., January was the most volatile one for the markets as it recorded several lows during the whole month and it is still declining with each passing day.

The only way out of the current negativity at the stocks is the outcome of the IMF-govt talks. If the talks were successful and IMF bailout was secured, then the market can be back to activities with positive direction.

It may also be mentioned here that a massive Rs170 billion in taxes are in pipeline on part of the government due to which the masses are bracing for tough times ahead as for imposing these taxes, a mini budget will be introduced as the Finance Minister has already said in media talk.

The export industry is also in doldrums and the 34% hike in gas tariff and the increase in prices of materials have badly hit the export oriented businesses as the price of doing business has multiplied.

Meanwhile, the Inflationary trends are peak and it touched a record this week with the yearly inflation reaching around 40 per cent which is unprecedented in nature.

The prices of essential commodities are sky-rocketing and beyond the reach of the common man, who is already running from pillar to post to make both ends meet. As reported, the lower middle class which is earning around 40, 000 per month is the most affected after the rise in prices of as many as 34 items.

Published in The Daily National Courier, February, 22 2023

Like Business on Facebook, follow @DailyNCourier on Twitter to stay informed and join in the conversation.