40pc of economy owned by retailers, merchants who pay negligible taxes

- 194

- 0

A global report released a few months ago revealed that there are only five industrial sectors in Pakistan that save taxes worth Rs 956 billion annually.

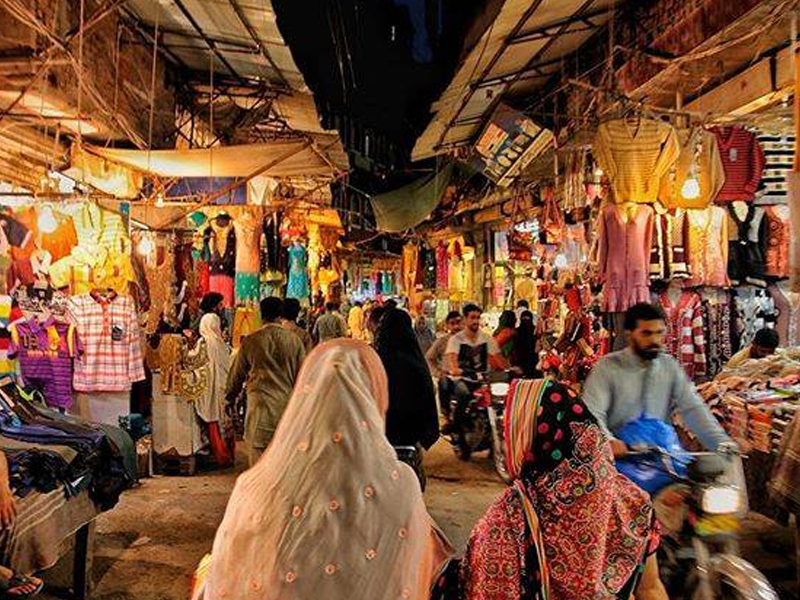

Among them are many people related to real estate, tea, cigarettes, tires and pharmaceuticals. Some retired FBR employees reveal the fact that 40% of the economy is owned by retailers and merchants who pay negligible taxes.

There is also no denying the fact that widespread smuggling under the guise of transit trade from neighboring countries has taken the form of a parallel and illegal economy.

An excuse is given by many people belonging to industry and trade, agriculture and service sectors is the deficit.

In this whole situation, only the salaried, crushed in the mill of inflation, is left behind, which is included in the regular tax net and pays all kinds of taxes. According to statistics, 66% of the country's taxable segment is outside the tax net.

Due to their non-involvement, the budget targets are kept at a very low level and when these are not met, the budget suffers from deficit.

According to reports, the Federal Board of Revenue has added 1.5 million new people in the tax net during the current financial year.

It has been decided to include, among them doctors, engineers, lawyers and other businessmen who have in one way or another exempted themselves from taxes.

Of these, notices have been issued to more than seven lakh people, besides data of other non-filers having taxable income is also being obtained through third parties.

However, the elements that create distortions in the economy do not deserve any discount.

Documenting the economy

Talks of tax on agricultural income have been going on in the country for decades because a large part of our population is agriculturists, but no significant progress has been made in this regard so far.

A clear proof of this fact is revealed in the recent report of the World Bank that 90% of agricultural workers in Pakistan do not pay taxes, while the share of taxes due to the improvement of income tax collection on agricultural income is one percent, while all the required reforms in the tax system may increase up to two percent.

According to the report, the reason for this poor situation of taxation on agricultural income is the lack of coordination between the federation and the provinces.

The overall status of income tax in the country can be estimated from the statistics of the World Bank that only 80 lakhs out of 11.4 million people with full employment, i.e. only about 14th of the total number, are registered for income tax.

These figures of the World Bank are certainly not surprising. The defects of our revenue system are not hidden from anyone.

According to analysts, only the salaried class pays full tax in Pakistan, while most of the landlords, property dealers, legal fraternity, education institutions, parliamentarians and rulers pay nominal tax.

This is the reason why the common man has to pay the heavy burden of indirect taxes in the country in the form of GST on all necessities and heavy taxes on electricity, gas, petrol etc.

This is also a major reason for the rampant inflation in the country. If the big zamindars, waderas, nawabs, jagirdars and powerful classes like property dealers, pay the full tax on their income, the situation can definitely change positively.

For this it is necessary to fully document the economy and modern technology has made this process much easier than in the past so immediate and fruitful progress should be made in this direction.

The irony is that instead of broadening the tax net, the successive governments have always burdened the tax-payers with additional taxes, while not bringing those in the tax-net, who should pay the taxes.

Due to this situation, the poverty graph is increasing the country. Pakistan has a high poverty rate, with more than 40 percent of the population living below the poverty line. Unemployment is another major economic challenge, with a large number of educated youth unable to find jobs.

The irony is that the government claims to be empowering the poor by provide financing opportunities through banks to the low-income segments of society.

But such claims do not hold water in the wake of increasing unemployment of educated youth and with the government inability to provide them with jobs to make them stand on their own feet. Providing a financing is one thing and making the youth standing their feet is totally another. According to a survey report by a research organization, 95 percent of Pakistanis are afraid of unemployment due to the country's conditions, only 5 percent are confident of being jobless. In 2023, 82 percent of people expressed disappointment regarding unemployment. Inflation and unemployment continue to be the top concerns of the Pakistani people, but rising electricity and oil prices have also raised their concerns.

Increase in poverty, load-shedding of electricity, interference of state institutions in each other's work, nepotism, bribery, additional burden of taxes, devaluation of rupee and non-supply of water were also identified as important issues by the voters added to the list.

These figures should be eye-opening for the ruling elite. At present, the real situation is that the industrial establishments are declining, many non-governmental organizations are firing their employees. In a country where more than one-third of the population lives below the poverty line, extraordinary measures are needed to solve the problem of the masses and instead of burdening the masses with additional taxes, the authorities concerned should identify those individuals who are liable to pay taxes but are not in the tax-net. To be very specific, the broadening of the tax-net is the only viable solution for the current scenario.

Published in The Daily National Courier, January, 02 2024

Like Business on Facebook, follow @DailyNCourier on Twitter to stay informed and join in the conversation.